Understanding Interest Rates through Memes

A Journey Through Time and Market Crises

On the eve of the 2nd FOMC meeting of the year, a potentially significant one, as explained by this meme (below), this post briefly explains what is Federal reserve Interest Rate, walk you through some history, and explain how it affects the economy.

Interest rates play a vital role in modern economies, influencing various aspects of business and personal finance. In this blog post, we will discuss what interest rates are, delve into their history, briefly explore how they impact markets, and examine notable interest rate-related events such as the 1980 and 1999 market crashes, the 2008 housing crisis, and to the end, the effects of post-COVID low interest rates.

What are Interest Rates?

Interest rates are the percentage charged on the principal amount of a loan or the rate paid on deposited funds. They represent the cost of borrowing money and are a vital tool used by central banks to control inflation, promote economic growth, and maintain financial stability. Interest rates can be divided into two categories: nominal and real interest rates. The nominal interest rate does not take inflation into account, while the real interest rate is adjusted for inflation.

The current Federal Reserve Nominal Interest rate, is 4.50% to 4.75% as of this writing (March 21, 2023), and the current 1-year Real Interest rate is estimated to be at 2.64% as of March 2023 (track 1-year real interest rates here).

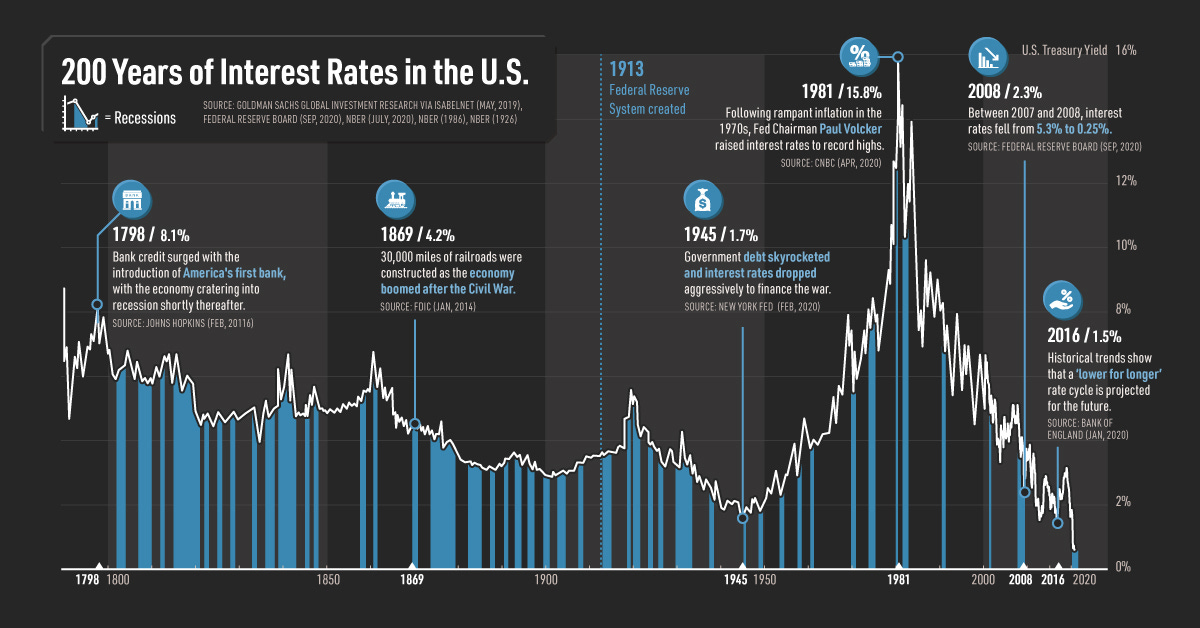

History of Interest Rate Hikes in the 1970s

The 1970s was a period marked by high inflation and interest rate hikes in the United States. In response to the rising inflation, the Federal Reserve, under the leadership of Chairman Paul Volcker, began to aggressively raise interest rates. In 1979, the federal funds rate, the interest rate at which banks lend to each other, reached 20%, a level not seen before or since. This era of high interest rates was aimed at curbing inflation and restoring economic stability.

The Federal Reserve usually adjusts interest rates in increments of 0.25% (25 basis points). However, during the period of extremely high inflation in the late 1970s and early 1980s, the Federal Reserve took more aggressive actions to control inflation. On October 6, 1979, under Chairman Paul Volcker, the Fed shifted its monetary policy approach, which led to significant increases in the federal funds rate over the following months.

This aggressive actions by the Fed resulted in drastic changes, causing the rate to rise from around 11% in September 1979 to around 20% by December 1980. Keep in mind that the Fed's adjustments during this period were not always made on a single day but rather through continuous and aggressive policy changes.

How Interest Rate Hikes Affect Markets?

Interest rate hikes can have significant impacts on financial markets, businesses, and consumers. When interest rates increase, borrowing becomes more expensive, leading to reduced consumer spending and business investment. Higher interest rates can also lead to a stronger currency, making exports more expensive and imports cheaper. This can result in a slowdown in economic growth and potentially lead to a recession.

In the stock market, rising interest rates can depress stock prices, as investors may shift their investments from riskier equities to safer fixed-income securities with higher yields. Similarly, higher interest rates can negatively impact the bond market, as bond prices typically fall when interest rates rise.

The 1980 and 1999 Market Crashes

The 1980 market crash was triggered by a combination of factors, including high inflation, tight monetary policy, and geopolitical tensions. The aggressive interest rate hikes implemented by the Federal Reserve to combat inflation led to a severe recession in the early 1980s, causing stock and bond markets to plummet.

The 1999 market crash, on the other hand, was primarily driven by the bursting of the dot-com bubble. While interest rates played a role in the run-up to the crash, the primary cause was the overvaluation of technology stocks and the subsequent collapse in their prices.

How Low Interest Rates contributed to the 2008 Housing Crisis

Low interest rates were a significant factor in the 2008 housing crisis. In response to the 2001 recession and the dot-com crash, the Federal Reserve lowered interest rates to stimulate economic growth. These low interest rates fueled a housing boom, as borrowing became more affordable, leading to increased demand for homes and a rapid rise in housing prices.

Loose lending practices, including the proliferation of subprime mortgages, also contributed to the housing bubble. When interest rates began to rise, many borrowers found themselves unable to meet their mortgage obligations, leading to a wave of foreclosures and the collapse of the housing market. The crisis then spread to the financial sector, as banks and other institutions were exposed to mortgage-backed securities that plummeted in value.

Then… Well, COVID happened, uncertainty loomed & market crashed, so to calm the markets & ease the economy, the FED slashed the interest rates to near 0% overnight.

Post-COVID Low Interest Rates and Effects

In response to the economic downturn caused by the COVID-19 pandemic, central banks around the world, including the Federal Reserve, slashed interest rates to historic lows to support economic recovery.

These low interest rates have had several effects on the economy and financial markets:

a. Stimulating borrowing and spending: Low interest rates have made borrowing more affordable for both consumers and businesses, leading to increased spending and investment. This, in turn, has contributed to the economic recovery in many countries.

b. Asset price inflation: Low interest rates have led to a surge in asset prices, particularly in the stock market and the housing market. As investors search for higher returns, they have poured money into these markets, driving up prices and valuations.

c. Debt accumulation: With borrowing costs at historic lows, governments, businesses, and households have taken on higher levels of debt. This has raised concerns about the sustainability of debt levels and the potential for future financial crises.

d. Income inequality: Low interest rates have disproportionately benefited those with access to credit and the ability to invest in assets like stocks and real estate. This has contributed to growing income and wealth inequality, as those without access to credit or investment opportunities have not seen the same gains.

e. Challenges for savers and retirees: Low interest rates have made it difficult for savers and retirees to generate income from traditional fixed-income investments, such as bonds and savings accounts. This has forced many individuals to take on more risk in their investment portfolios, potentially exposing them to future market volatility.

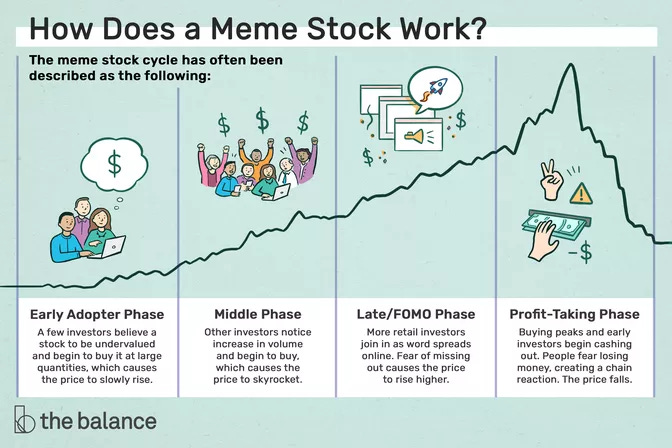

But these aggressive actions by the Government, while addressing the Covid crisis, also resulted in a disconnect between the stock market and real economy.

“The Meme Economy” Boom & Bust in a nutshell (2020-2023):

Conclusion

Understanding interest rates and their impact on the economy and financial markets is crucial for both policymakers and investors. While low interest rates can stimulate economic growth, they can also lead to asset bubbles and increase inequality.

As the global economy continues to recover from the effects of the COVID-19 pandemic with interest rates already hiked up to near 5%, it will be important to monitor how central banks continue to manage interest rates to balance the need for growth with the risks of financial instability (or avoiding potential bankruns).

Disclaimer: Memes are not mine, charts are not mine either, I don’t own the FED. And I used chatGPT, or forget it, I am ChatGPT.